While the long-term and potentially negative effects of the UK leaving the EU remain to be seen, business confidence following the referendum remains low. Key areas of concern are a decline in the UK economy, exchange rate volatility and a decline in consumer confidence.

Politicians – given the status of the UK as an advanced and prosperous society — are, following the decision to leave the European Union, banking on the likelihood that everything will be all right (for the majority of people), in at least the mid-term. Whether things will be as good, economically, as in a counterfactual in which the UK remained an EU member, remains an open question.

Prior to the referendum, businesses warned of possible negative effects to parts of the business community, particularly to those with exports to the EU, were the UK to vote to leave. A survey of UK businesses by Grant Thornton, held post-EU referendum, finds that business confidence following the decision is subdued, with 49% saying that they are less confident about the year ahead, while 8% say that they are more confident. Around 20% of businesses also indicate that they are actively planning to decrease investment, while 56% say that investment levels will remain unchanged. The areas of most critical concern for respondents include a decline in the UK economy, at 74% of respondents, the impact of exchange rate movements, cited by 57% of respondents, and declining consumer confidence, cited by 55% of respondents.

The consultancy firm also asks respondents to indicate what policies the new government should prioritise to boost business confidence. Top of the list is full access to the single market, cited by 67%, followed by continued EU recognition of equivalence of UK regulations and standards, including 'passporting', cited by 52% of respondents. Laying trade deals outside the single market is cited by 50% of respondents, while continued free movement of people, is cited by 42%.

Robert Hannah, Chief Operating Officer at Grant Thornton UK, comments, "Whilst much of the immediate political and economic turbulence following the outcome of the vote has settled over the past few weeks, the general outlook for the UK economy remains a top concern for most businesses. Many of the businesses we speak with are taking a business-as-usual approach to their day-to-day operations, but looking further into the horizon, some are reconsidering their investment intentions based on the post-vote indicators and general mood music in the markets.”

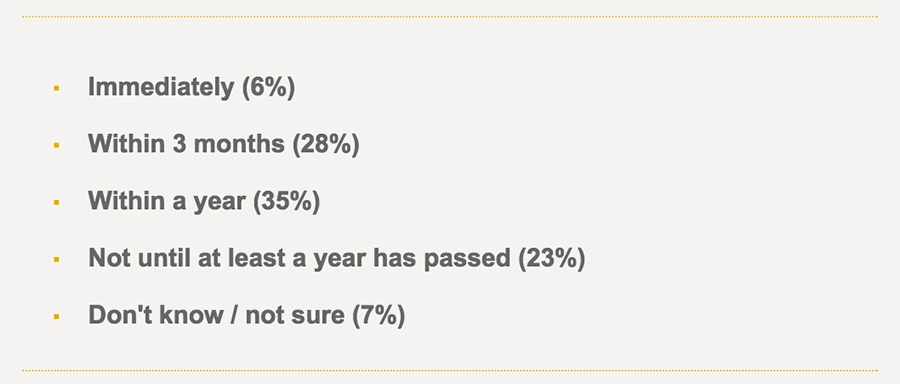

The move to formally exit the EU, the triggering of article 50, is yet to be made. The survey also asks businesses what their thoughts are with regard to when the government should trigger the article. 6% of respondents believe it should be triggered immediately, while 28% said within three months. 35% of respondents said within a year, while 23% of respondents think it should not be triggered until at least a year has passed.

Hannah continues, "Despite the lack of consensus on the timing for article 50 to be triggered, the general sentiment we're getting from clients and the market is that they want the government to have a clear vision before beginning the negotiations. Businesses are encouraging the government not to rush the process, but acknowledge that delaying it increases uncertainty, which is equally bad for business. Negotiating Brexit and determining a new legal and regulatory framework for the UK is an unprecedented challenge. It's critical that the government use this opportunity to collaborate across the public, private and third sectors to make this happen so we can look back and feel proud of how all contributed to our nation's future at this critical stage."

Read more at www.consultancy.uk